Market research for a marketplace platform MVP is the difference between launching early and wasting months on features no one needs. This guide walks founders and product managers through the tests that matter most. I focus on low cost experiments, acceptance criteria, and signals that predict scale. Many startups miss the two sided nature of marketplaces and treat supply and demand channels the same. Read this to learn how to talk to users, run fast experiments, and turn results into a lean roadmap that reduces risk.

Why Early Research Matters

Early research is the difference between a product that ships and one that finds customers. Founders often assume both sides of a marketplace will appear once code is done. That rarely happens. The goal of early work is to prove that buyers and suppliers exist and that they value the same exchange. Talk to at least twenty potential users across roles. Run light experiments that force a choice. Measure conversion intent not just interest. Use simple funnels to track supply activation and buyer retention. Keep records of quotes and pricing preferences. Many startups miss this and learn the hard way. Good research lowers risk and speeds iteration. It also surfaces distribution channels that actually work. Prioritize the riskiest assumptions and document what would prove them false.

- Test both buyer and seller demand early

- Measure intent not just opinions

- Track simple funnels daily

- Document quotes and pricing signals

Define Your Hypotheses And Metrics

Start by listing your riskiest hypotheses. State what must be true for the marketplace to scale. Think in terms of supply density per zip code, typical transaction size, and repeat rates. Attach a measurable metric to each hypothesis. For example set targets for activation time, first week retention, and margin per transaction. Define the test that will validate or invalidate each idea. Keep tests short and cheap. Use unit economics to guide product choices. If numbers do not work on paper the product will need a different model. A pragmatic view is better than optimistic wishful thinking. Many founders want to skip this and they pay for heroics later. Build simple dashboards to watch key metrics daily. Revisit hypotheses after each test and update the plan.

- Write one hypothesis per risk

- Give each hypothesis a numeric success metric

- Map tests to owners and deadlines

- Monitor unit economics from day one

Talk To Real Users

Talking to real users is the fastest way to find product market fit. Recruit balanced samples from both buyer and seller sides. Use empathy and open questions to learn workflows. Avoid pitching features during research. Observe behavior when possible. If you can not watch users in person use screen shares or video. Validate the value proposition with landing pages that collect email and pre orders. Run short alpha tests that simulate the matching process manually. A concierge approach will reveal hidden friction. Document quotes and playback sessions for the team. Insights from ten good conversations are worth more than a hundred survey responses. Recruit marketplace users from forums, social groups, and targeted ads. Be honest and pay for their time when needed. Record interviews and tag themes for later synthesis.

- Interview both sides of the market

- Use a concierge test to simulate core flow

- Record and tag themes for synthesis

- Pay participants when possible

Quantitative Tests And Market Sizing

Do quantitative tests to estimate demand and scale. Run targeted ads to a landing page to measure click to sign rates. Use simple surveys for willingness to pay and to find price sensitivity. Build a model for total addressable market and calibrate it with real signals. Track conversion at each funnel step. Use small paid campaigns to test acquisition cost ranges. If acquisition cost is higher than lifetime value the model fails. Look for leading indicators like intent to pay and referral rates. Quant data gives you guardrails. Combine it with interviews to explain outliers. Estimate the market size conservatively and make assumptions explicit. Use public datasets and category reports to bound your numbers. Run A B tests for messaging to improve relevance.

- Validate demand with paid traffic

- Capture willingness to pay in surveys

- Model TAM and calibrate with signals

- Run A B tests for messaging

Competitive And Ecosystem Mapping

Map the competitive landscape and the broader ecosystem. Identify direct competitors and indirect substitutes. Do not ignore adjacent services that can become partners. Look at where buyers currently spend time and money. Study regulatory, logistics, and payments constraints that might limit growth. Note the distribution channels each competitor uses. A good map reveals niches and white space. It also shows what user expectations are around speed, price, and trust. Make a simple chart that compares features and seller economics. Many startups fail to map partners and they lose distribution. Include product reviews and complaints to spot gaps. Talk to potential partners to understand onboarding friction. Do short pilots to see if partnerships can move supply quickly. Document the results in a shared folder for the team.

- Map direct and indirect competitors

- Identify potential partners and pilots

- Note regulatory and logistics limits

- Collect review and complaint signals

Minimum Viable Matching And Pricing Experiments

Design experiments that test matching and pricing early. Start by seeding supply in a small area and run demand campaigns there. Test two sided incentives separately. Use promo credits carefully to avoid training users to expect discounts. Try fixed price offers and negotiable pricing to see which yields faster matches. Measure time to first match and repeat transactions. Build a minimal matching flow that is easy to operate manually if needed. Monitor supply churn closely. Pricing and matching are the heart of a marketplace and they reveal unit economics fast. Be ready to pause features that hurt matching rates. Experiment with different onboarding scripts for suppliers and track activation. Run pricing ladders to find the sweet spot between margin and volume. Keep iterations short and measure impact.

- Seed a small geography first

- Test incentives per side separately

- Measure time to first match

- Run pricing ladders to find optimal price

Turn Insights Into A Lean Roadmap

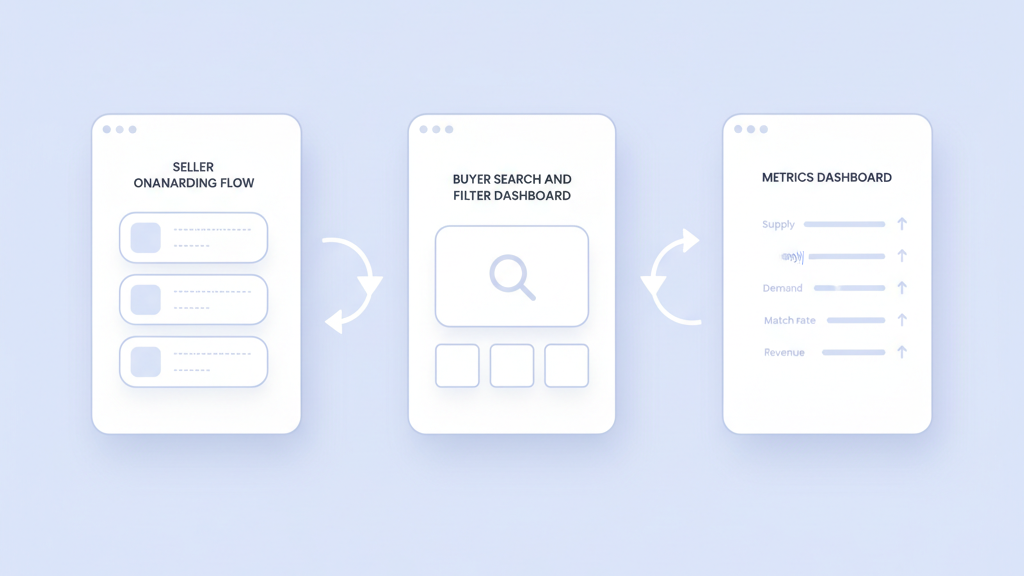

Turn research into a lean roadmap that links experiments to milestones. Prioritize work that reduces the biggest unknowns first. Set clear success criteria and time boxes for each experiment. Use OKRs for early traction metrics like activation and retention. Feed learnings back into product decisions each week. Plan for staged launches across geographies to control supply density. Keep the roadmap flexible and prune ideas that fail measurable tests. Share results with stakeholders often. Many founders misinterpret feedback and keep building features that do not move metrics. A disciplined loop beats optimism every time. Assign owners and weekly check ins to keep momentum. Translate each major insight into a product task with acceptance criteria. Revisit the plan monthly and reallocate resources based on evidence.

- Prioritize experiments that reduce the biggest risks

- Set numeric success criteria and time boxes

- Translate insights into product tasks

- Run staged launches to control density