Building a fintech mobile app MVP for secure onboarding is about trade offs. You must move fast and still protect users and the business. This guide helps founders and product managers prioritize identity checks, smooth UX, and simple compliance in a way that reduces friction and avoids common pitfalls.

Designing A Risk Based Onboarding Flow

Start by mapping the minimal path that still manages risk. List the highest value actions you need to allow and the highest risks you must block. Apply a tiered approach where low risk users get lighter checks and higher risk users trigger more verification. Use progressive profiling so you only ask for extra data when it matters. Many startups miss this and try to verify everything up front which kills conversion. Keep the flow short and test alternate paths in real conditions. Prioritize checks that have automated decisioning and clear failure modes so you can iterate quickly without manual bottlenecks.

- Map user journeys by risk level

- Use progressive profiling

- Automate initial decisioning

- Flag high risk for escalation

Choose Lightweight Yet Strong Identity Checks

Pick identity checks that balance speed and assurance. Start with document ID plus selfie matching for a solid base. Add data verification against trusted third party providers for address and identity where needed. Consider device signals like phone number verification and device fingerprinting to detect fraud. Avoid heavy manual reviews in the MVP unless you have resources to do them well. Use vendors that provide clear scoring and fast responses so you can tune thresholds. Watch out for edge cases such as privacy protected records and name mismatches which are common in the US market.

- Start with ID and selfie match

- Add third party data checks

- Use device signals for fraud

- Choose vendors with fast scoring

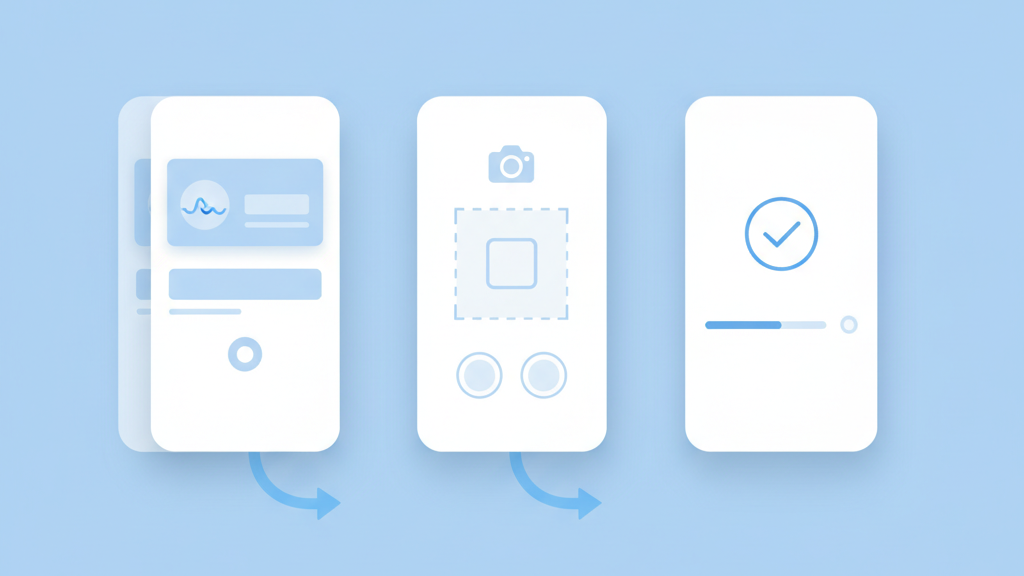

Make Security Invisible To Users

Good security should not feel like punishment. Design flows that guide users with simple instructions and feedback. Use inline validation and clear microcopy to reduce errors. Implement biometrics and passkeys when possible so returning users skip repeated checks. Keep the number of fields low and prefer camera capture over manual entry for documents. Test the flow on low end devices and slow networks to avoid surprises. A small design decision can reduce drop off significantly, and founders should treat onboarding performance as a product metric worth optimizing early.

- Use inline validation and microcopy

- Favor camera capture over typing

- Offer biometric return paths

- Test on slow networks and old devices

Regulatory And Privacy Foundations

Address compliance early with a focus on US rules and sector best practices. Determine if you need KYC, AML monitoring, or specific state licensing based on services offered. Build a simple data retention and consent model that explains why you collect each item and how long you will keep it. Encrypt sensitive data in transit and at rest and limit access with role based controls. Many startups under invest in legal and privacy up front which leads to expensive rewrites. Keep records audit ready and document vendor contracts so you can scale without surprises.

- Map KYC and AML requirements

- Create a clear data retention policy

- Encrypt data and use role based access

- Document vendor and audit details

Testing Monitoring And Metrics

Measure the right signals to improve onboarding. Track conversion at each step, time to complete, and failure reasons. Monitor fraud scores and geographic anomalies in real time. Use synthetic tests to catch regressions and run A B experiments on microcopy and field order. Instrument logs for suspicious patterns and set alerts for spikes in verification failures. Many teams focus only on final conversion and miss small wins that compound. Treat onboarding as an ongoing system to tune and allocate engineering time to fix the biggest drops first.

- Track step level conversion

- Log failure reasons and score trends

- Run synthetic tests and A B experiments

- Alert on verification failure spikes

Scaling The MVP To Production

Plan for scale from day one but avoid over engineering the MVP. Design modular services for identity checks, fraud scoring, and user data so you can swap vendors without a full rewrite. Build idempotent APIs and clear replayable logs to support audits and dispute resolution. Monitor vendor SLAs and add fallback paths for key checks. Prepare a roadmap for adding manual review only where automated systems have high false positives. Finally, budget for ongoing costs as identity and fraud checks can become a material line item once you grow.

- Modularize identity and fraud services

- Use idempotent APIs and replay logs

- Add vendor fallbacks for SLAs

- Budget for verification costs