Marketplace platform MVP user flows for founders is a practical starting point for any early team. Map the smallest set of screens that prove the business model and reduce guesswork. This intro is for founders and product managers who want to prioritize learning over polish. I favor speed and feedback over perfect design. Many startups miss the moment when simple flows would have exposed fatal assumptions. In this guide you will see how to pick core users, sketch minimal onboarding, and decide which payments and trust features matter first. The end goal is a repeatable path from signup to meaningful action. Keep the flows tight and instrumented so you can iterate on real user signals.

Start with core jobs

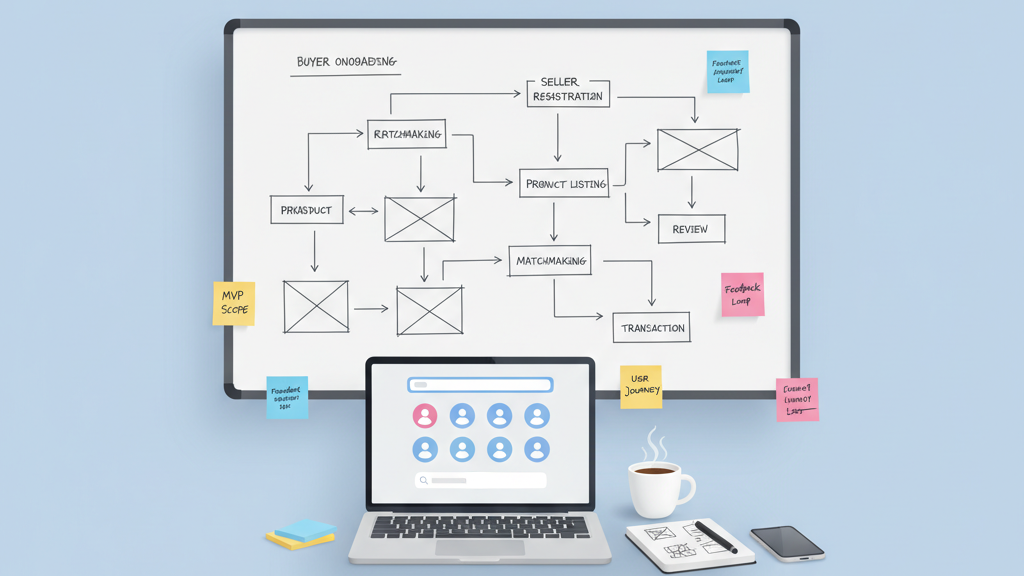

Begin by naming the two or three core jobs your marketplace must enable. Do not try to support every use case at once. Focus on the buyer action that leads to a paid transaction and the seller action that creates supply. Sketch the ideal path for each user on paper or a whiteboard. Include how users find listings, how they initiate contact, and how payment completes. Think about edge cases but exclude them from the first build. Founders often overestimate what users need on day one. That is a costly mistake. A narrow job list helps you prioritize screens and measure success. Prioritization also reduces development risk and shortens the feedback loop. Keep the document simple and share it with the engineering team before coding starts.

- List the two main user roles

- Define a single primary transaction

- Map the find contact pay path

- Exclude edge cases initially

- Share the sketch with engineers

Onboarding that proves intent

Design onboarding to show intent not to collect every data point. Use progressive capture so you get the minimum information that enables a transaction. For buyers this often means contact and payment readiness. For sellers it means an active listing and fulfillment details. Include a quick verification step if trust is critical but keep it lightweight. Use soft nudges to guide users toward the action that validates demand. Instrument events for every step so you can see drop offs. A good onboarding flow shortens time to first meaningful action. I recommend testing two variants early because small changes can change conversion dramatically. Many teams forget to measure and misinterpret poor onboarding as product market fit problems.

- Capture only essential user data

- Use progressive disclosure

- Add lightweight verification

- Track events at each step

- Test two onboarding variants

Listing and discovery

Keep listing creation friction low for sellers. Ask for the few fields that make a listing discoverable and bookable. Photos help but do not block the flow. For discovery build a simple ranking that surfaces new and relevant listings. Filters and search can come later. For an MVP a clear landing page with a small set of categories and a strong call to action is enough. Monitor how users search and what filters they use to inform future iterations. Consider manual curation to improve early matches. That is not scalable long term but it boosts conversion and gives you learning. Founders should accept a bit of manual work to learn fast rather than over engineering discovery features.

- Minimize listing fields

- Make photos optional at first

- Start with simple ranking

- Use manual curation early

- Measure search and filter usage

Payments and financial flows

Decide on the simplest payment path that still proves monetization. Escrow, commissions, or direct payments each have trade offs. Pick the model that matches your trust needs and regulatory reality. Integrate a payment provider that reduces work for your team and supports the currencies you need. Do not build complex split payments in the first release unless your business model requires it. Show the minimum invoice or receipt that gives both parties confidence. Log financial events in an auditable way and expose them in admin tools. Payments are a common failure point so add manual fallbacks for early transactions. That will save customers and avoid missed revenue while you refine automation.

- Choose the simplest monetization model

- Use an off the shelf payment provider

- Delay split payments if possible

- Record auditable financial events

- Provide manual fallbacks early

Trust and safety basics

Trust is more than reviews. Include simple safety nets like confirmed contact details, photo verification later, and clear transaction terms. For an MVP focus on signals that increase confidence without large overhead. Add a basic dispute path that routes to an admin for manual resolution. That reduces reputational risk while you learn typical failure modes. Display simple reputation indicators such as first time seller badges or verified email icons. Communicate clear expectations for refunds and cancellations. I believe many founders underestimate the cost of ignoring trust up front. A small investment in clear rules and responsive support goes a long way toward repeat transactions.

- Add minimal verification signals

- Provide a manual dispute path

- Show simple reputation badges

- Publish clear refund rules

- Monitor trust related incidents

Messaging and conversion triggers

Build a lightweight messaging channel that drives the transaction forward. The goal is to convert interest into commitment. Use templates and quick replies to reduce friction. Send reminders for incomplete bookings and confirmations for completed transactions. If notifications are too noisy users will disable them so tune frequency carefully. Capture which messages lead to conversions and which do not. Consider in app chat first and add email or SMS as needed. Keep audit trails of conversations for dispute resolution. My opinion is that messaging design often makes or breaks early marketplaces because it controls the tempo of deals. Test timing and content aggressively to find the right balance.

- Implement simple in app messaging

- Use quick reply templates

- Send targeted reminders

- Track message to conversion rates

- Keep conversation audit trails

Admin tools and fraud controls

Deliver a small set of admin tools that let you intervene and learn. Build pages to view transactions, adjust payments, and resolve disputes. Add alerts for suspicious patterns such as repeated chargebacks or abnormal listings. Manual review workflows are fine at first and often reveal rules you will automate later. Keep logs that show the sequence of events for each case. Limit admin complexity to what you can operate reliably. Over engineered admin panels waste time and slow response. Many founders want polished dashboards but I prefer simple controls that speed decisions. The admin area is where you fix problems before they scale into churn.

- Start with a compact admin dashboard

- Add fraud alerts for key patterns

- Enable manual payment adjustments

- Log events for each transaction

- Automate rules after learning

Measure learn iterate

Instrument every step in your user flows to learn quickly. Track funnel metrics from listing to payment and the time between key events. Use qualitative feedback to explain what the numbers show. Run short experiments on copy, CTAs, and small UI tweaks. Measure one metric per experiment so you can attribute change. Use session replays or quick interviews to understand why users drop off. Schedule regular reviews and make decisions based on data and team context. A pragmatic view is that no metric is perfect but trends reveal what to fix. Many startups either drown in analytics or ignore them. Balance is the hard part and it pays off fast.

- Instrument key funnel events

- Run focused experiments

- Combine quantitative and qualitative data

- Optimize one metric at a time

- Review findings regularly